A Home loan EMI (Equated Monthly Installment) is a fixed monthly payment comprising principal amount and interest, repaying a housing loan. The formula for EMI is: EMI = [P * r * (1 + r)^n] / [(1 + r)^n 1], where P is the loan amount, r is the monthly interest rate, and n is the loan tenure in months. For instance, a ?10,00,000 loan with a 5% annual interest rate for 20 years has a monthly EMI of approximately ?6,.

What is EMI?

EMI signifies Equated Monthly Fees. Its a predetermined commission amount made by a debtor in order to a lender during the a designated time for every calendar month. EMIs are accustomed to pay-off both notice and dominating number out-of financing, making certain more than a certain very long time, the borrowed funds is repaid entirely.

In the context of a mortgage, the EMI ‘s the payment you to a debtor tends to make so you’re able to pay-off the home mortgage. The brand new EMI consists of a couple of elements: dominant and you may attention. The attention role is actually higher in the very first age, and as the borrowed funds are reduced, the attention portion decrease, as the principal cost develops.

Brand new EMI computation considers the mortgage matter, interest, and you may financing period. It provides consumers a handy treatment for finances its month-to-month earnings while they pay-off the mortgage more than an extended period.

EMI Break-right up

The newest EMI (Equated Month-to-month Repayment) break-upwards includes one or two chief section: dominating and you can desire. When you create a payment to your mortgage, a fraction of it is towards paying down the primary amount borrowed, and also the almost every other piece goes to the paying the appeal recharged towards the the new a fantastic financing balance.

Principal Amount : This is the count you borrowed initially on the financial. For every single EMI percentage has a share seriously interested in reducing the dominant balance due. Since you continue and also make repayments, the latest a good dominant decreases.

Attract Matter : Here is the price of borrowing from the bank which can be charged by the bank. During the early several years of the borrowed funds tenure, a significant part of the EMI goes for the make payment on desire. While the a good prominent minimizes through the years, the eye parts and minimizes.

As you advances from the mortgage period, this new ratio of your EMI spent on the primary gradually increases, since the desire bit minimizes. By the end of your own loan tenure, of course regular and you will timely money, the complete principal count will be paid back, plus the financing will be completely settled.

It is vital to remember that the latest EMI matter stays constant through the the loan period, nevertheless proportion used on dominant and you can notice change throughout the years according to the amortization plan.

Just what Circumstances Influence Mortgage EMI

The new Equated Monthly Fees (EMI) to have a mortgage relies upon numerous things, and these affairs gamble a crucial role within the calculating the new month-to-month installment number. Here are the key factors you to determine our home financing EMI:

Loan amount : The primary number and/or total amount borrowed for purchasing the Home is a key point. A higher amount borrowed can lead to increased EMI, and in case additional factors will always be constant.

Interest rate : The interest rate recharged by financial try an important factor. A high interest rate results in a higher EMI, and you will in contrast, less interest leads to a lowered EMI. The pace is normally shown toward an annual base.

Mortgage Period : The newest duration where the mortgage is removed, known as the mortgage tenure, are a significant foundation. An extended period may lead to a lesser EMI, but it addittionally mode paying a whole lot more interest along side whole financing period. In contrast, a smaller period contributes to a top EMI however, straight down overall attract paid off.

Function of great interest Computation : Lenders explore various ways to assess appeal, instance fixed otherwise floating interest levels. Fixed cost are nevertheless constant regarding the financing period, while floating cost changes considering industry conditions.

Prepayments and you may Part Money : Any prepayments or area repayments produced toward financing make a difference to this new EMI. These types of payments slow down the a good dominant, potentially causing less EMI otherwise a shorter loan tenure.

Credit history : This new creditworthiness of your debtor, as the expressed from the the credit rating, can affect the speed provided by the lender. A high a credit rating can lead to a lower attention price and you may, therefore, a lowered EMI.

Insights this type of items is vital to possess individuals to assess the payment capability and choose a mortgage you to definitely aligns with regards to monetary needs and you will capabilities.

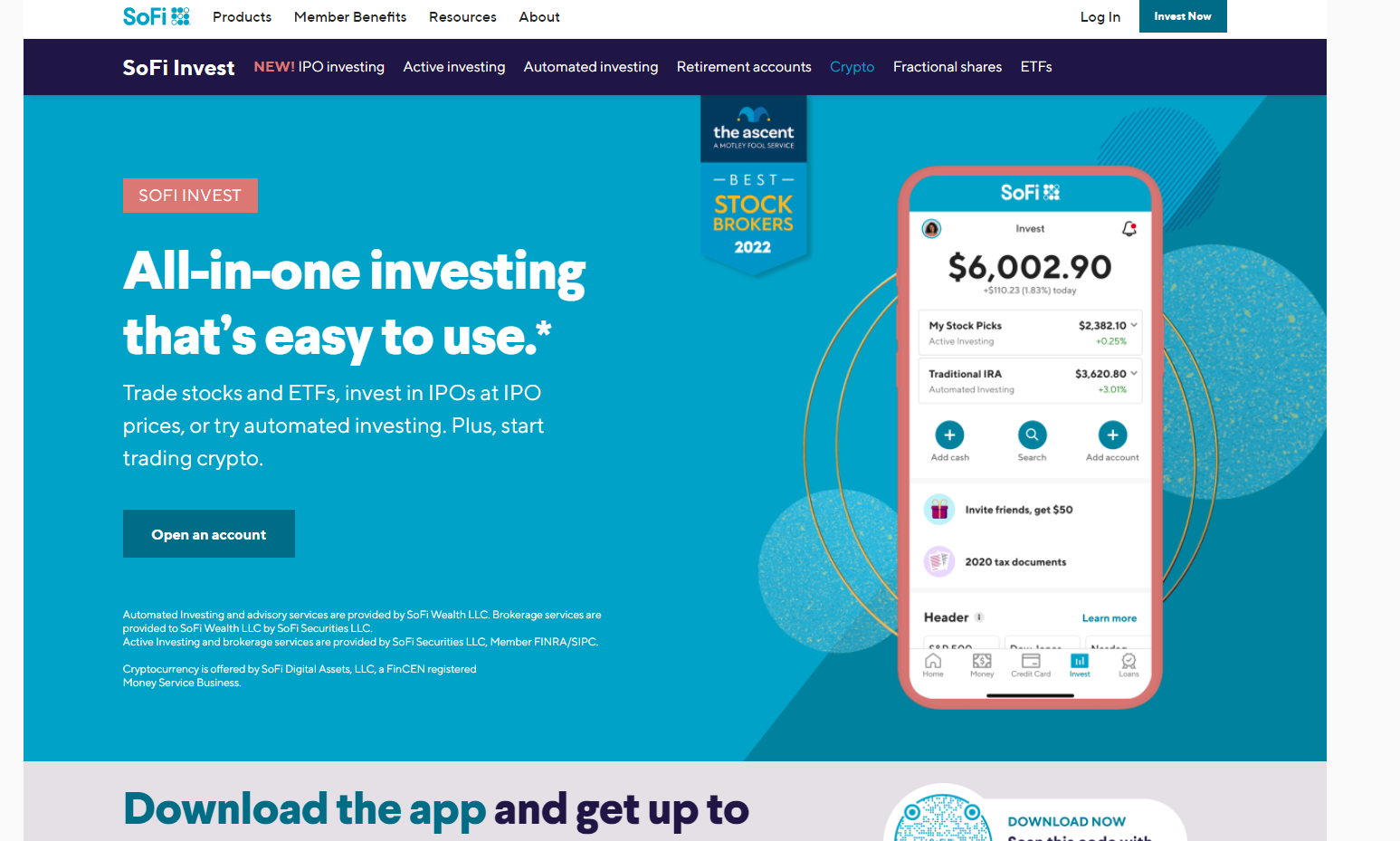

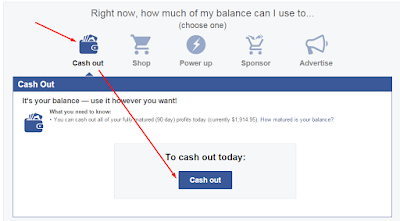

Estimate EMI using online EMI Calculator

Discovered immediate results exhibiting your own month-to-month EMI, overall appeal, and you can full fees. Make use of this guidance to own top financial considered and you may choice-and work out.

Advantages of choosing Financial EMI Calculator

Exact Cost Thought : EMI calculators bring accurate computations out-of monthly installments based on loan number, interest, and you will tenure. It accuracy facilitate consumers bundle the funds better.

Economic Visibility : By using an EMI calculator, consumers can acquire insight into the whole payment construction, including payday loan Athens the dominating and desire portion. It visibility helps into the understanding the investment decision along side financing tenure.

Budgeting Device : EMI calculators help somebody finances its profit giving a definite picture of brand new month-to-month dollars outflow to your financing repayment. This enables borrowers to help you line-up their expenditures and their earnings far more effortlessly.

Brief Decision making: EMI calculators offer immediate results, making it possible for borrowers making quick and you may advised ounts, tenures, and you will rates. That it speed is very effective in relation to some loan problems.

Prepayment Investigation : Getting individuals offered prepayments otherwise part money to their money, an EMI calculator facilitate learn the new effect on the general payment matter and you can tenure. This article helps for making conclusion regarding the increasing loan installment.

User-Amicable Program : Extremely EMI hand calculators are member-amicable, demanding simply basic enters such as for instance loan amount, interest rate, and you may period. Which simplicity makes it open to an array of users.

Avoiding Surprises : EMI hand calculators prevent surprises giving a clear overview of the fresh payment construction. Borrowers is also welcome and plan for fluctuations within their economic duties over the years.

The bottom line is, a keen EMI calculator is actually an important equipment one to allows individuals with monetary understanding, aiding into the effective planning, budgeting, and choice-and also make regarding the mortgage installment processes.

Conclusion

To summarize, understanding the thought of Financial Equated Month-to-month Payment (EMI) is key for folks navigating the fresh complex landscapes out of homeownership. EMI serves as the cornerstone regarding financing installment, representing a frequent and predictable financial commitment. The newest calculation away from EMI pertains to a beneficial nuanced interplay off situations particularly as amount borrowed, interest rate, and period.